Managing Multiple PayPal Accounts: A Guide for Modern Business

PayPal is a secure way for anyone to send and receive money electronically, and it’s the leading digital payment platform, helping millions of people and businesses send and receive money worldwide. In today’s fast-paced business environment, more and more companies are finding themselves needing to manage multiple PayPal accounts.

Running different businesses? Selling in various markets? Gotta keep personal and business cash separate? We’ll show you how to manage multiple PayPal accounts like a pro and introduce GeeLark, a tool that makes it way easier.

What Is PayPal?

PayPal is a widely-used digital payment platform that revolutionized online financial transactions by creating a secure and convenient way for individuals and businesses to send and receive money electronically. Founded in 1998 as Confinity before merging with X.com, it has grown to become one of the world’s largest and most trusted online payment systems, processing billions of transactions annually across more than 200 markets globally.

Who Owns PayPal?

PayPal gained independence in 2015 after splitting from eBay. Currently, it operates as a public company traded on NASDAQ (ticker symbol: PYPL), owned by a diverse mix of institutional investors, funds, and individual shareholders.

How Does PayPal Work

PayPal operates as a sophisticated intermediary between users’ financial accounts and merchants. Therefore, it creates a secure buffer for online transactions. Moreover, users can easily link their bank accounts, credit cards, or debit cards to their PayPal account, thus enabling seamless payments and transfers worldwide.

Additionally, the platform implements state-of-the-art encryption protocols and multiple security layers, hence ensuring transaction safety for millions of users globally.

PayPal and Venmo: What’s the Connection?

It’s also worth noting the connection between PayPal and Venmo. PayPal actually owns Venmo, a popular mobile payment service known for its social features and ease of use for splitting bills among friends. PayPal’s more for general online business, while Venmo started with those casual friend-to-friend payments. But they’re kinda merging. Some stores that take PayPal also let you pay with Venmo. You can’t directly send money between PayPal and Venmo super easily yet. If your business deals with a lot of those Venmo users, it’s good to know, but it doesn’t change why you might need multiple PayPal accounts.

Why You Might Need Multiple PayPal Accounts

You might need multiple PayPal accounts for several key reasons. If you’re running a business, separating your personal finances from your business transactions is a no-brainer. It keeps your books clean and simplifies your accounting.

For business owners, this separation is particularly important for clear accounting and tax purposes. International businesses find it helpful for handling different currencies, while agencies and freelancers can better track client-specific transactions.

- Keep personal and business separate: This is crucial for easy accounting and following the rules.

- Different accounts for different businesses: If you run multiple ventures, it’s cleaner to track each one separately.

- Accounts for different markets: Helps you cater to different regions or customer groups.

- Spread out transactions: Helps you stay within PayPal’s limits and keep things running smoothly.

While a personal account and a business account are enough for most people, some situations call for more. For example, if you’re managing multiple brands or selling on different platforms, separate accounts can be a game-changer. They help you track how each brand or platform is performing and keep your finances crystal clear.

So now that we’ve covered why you might want multiple PayPal accounts, let’s tackle the next big question.

Playing by PayPal’s Rules

PayPal’s rules are simple: you can have one personal account and one business account per person. If you try to create more accounts than allowed, PayPal might limit what you can do, temporarily suspend your account, or even shut it down permanently. It’s important to follow these rules to keep your accounts in good standing.

The Challenges of Managing Multiple PayPal Accounts

While having multiple accounts can be a smart move, it comes with its challenges. Managing multiple PayPal accounts presents several hurdles:

Account Security

Keeping multiple PayPal accounts secure is challenging and requires constant attention. You need to create and remember different strong passwords for each account, and keep track of various security settings. This makes it harder to protect all your accounts from unauthorized access, especially since you need to regularly check and update the security features for each one.

Transaction Tracking

Keeping track of transactions across multiple PayPal accounts can be challenging. As you add more accounts, it becomes harder to track all your payments, refunds, and fees accurately. When you need to move money between accounts or create financial reports, the process takes a lot of time. If you’re not careful, this can lead to mistakes in your accounting.

Compliance and Regulations

When managing multiple PayPal accounts, you need to follow certain rules and regulations. Each account must follow PayPal’s terms of service and various financial laws, including tax rules and anti-money laundering laws. The more accounts you have, the harder it becomes to keep track of and follow all these rules.

IP and Device Management

PayPal employs sophisticated security algorithms to monitor access patterns. When multiple accounts are accessed from identical IP addresses or devices, their system may:

- Flag suspicious login patterns as potential security risks

- Temporarily limit account functionality or request additional verification

- Track device fingerprints to detect shared devices across accounts

- Monitor login locations and timing to identify unusual patterns

Organization

Keeping track of account credentials, transaction histories, and customer interactions across multiple accounts can be overwhelming.

The biggest headaches are PayPal’s IP restrictions and keeping everything organized.

Many experienced online sellers and marketers are familiar with phone farm—a method of running multiple accounts by keeping them on different devices to prevent account linking and banning.

However, managing multiple devices for sustainable multi-account operations can be impractical, even though phone farms are common these days. What if there was an antidetect solution that could keep all your PayPal accounts in one place?

Simplifying Multiple PayPal Account Management with GeeLark

This is where GeeLark comes into play. GeeLark offers a solid android antidetct solution for managing multiple PayPal accounts securely and efficiently.

It gives you isolated environments (with optional mobile and browser profiles), each with its own unique digital fingerprint, so PayPal doesn’t link your accounts. This boosts your security and avoids those security flags.

Each GeeLark cloud phone has unique IP and device identifiers, mimicking real mobile devices. You can manage all your PayPal accounts from one place, simplifying logins and switching. GeeLark’s mobile environment looks like a real Android phone to PayPal, easily getting around restrictions.

GeeLark makes managing multiple PayPal accounts way smoother, safer, and compliant.

Setting Up Your Multiple PayPal Accounts

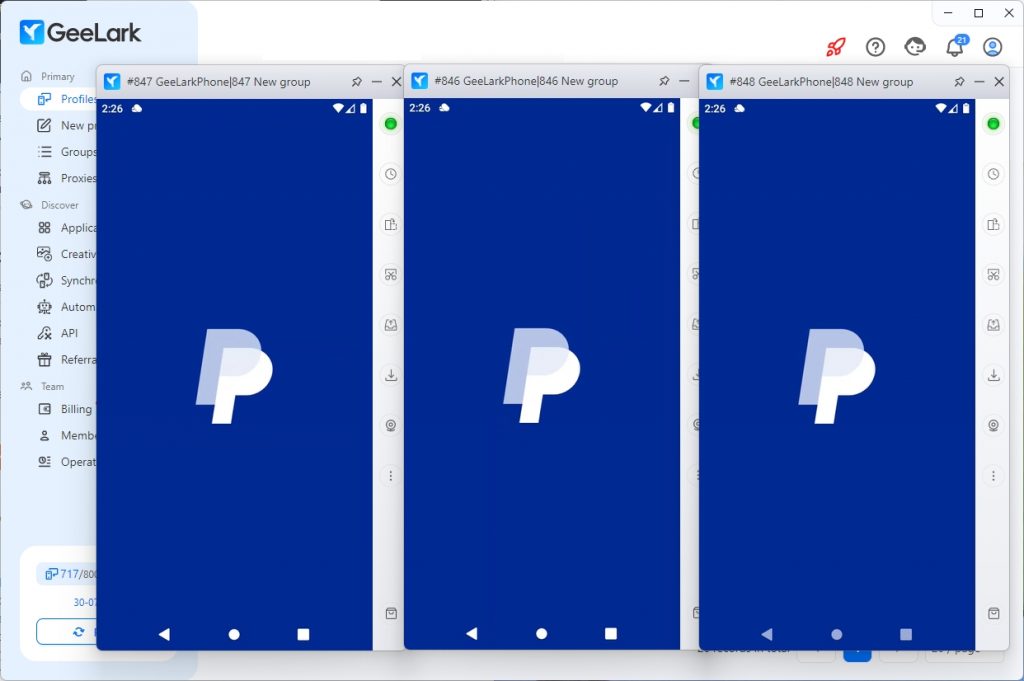

Setting up multiple PayPal accounts with GeeLark is simple and secure. Each cloud phone acts like a separate Android device, helping you manage multiple accounts safely from one desktop app. Since each account appears to come from a different device, PayPal won’t link your activities together.

Here’s how to get started:

Sign Up: Head over to GeeLark’s website to download and create your account. Pick a plan that works for you.

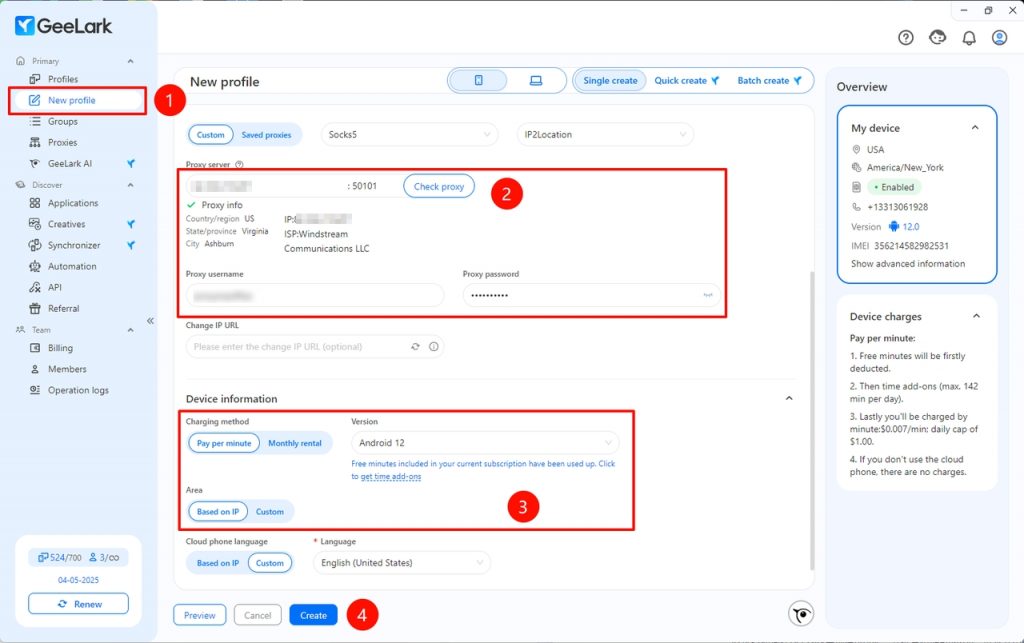

Create Cloud Phone Profiles: After logging in, just click New profiles to set up a cloud phone. Add your proxy details and you’re good to go. You can make as many profiles as you need.

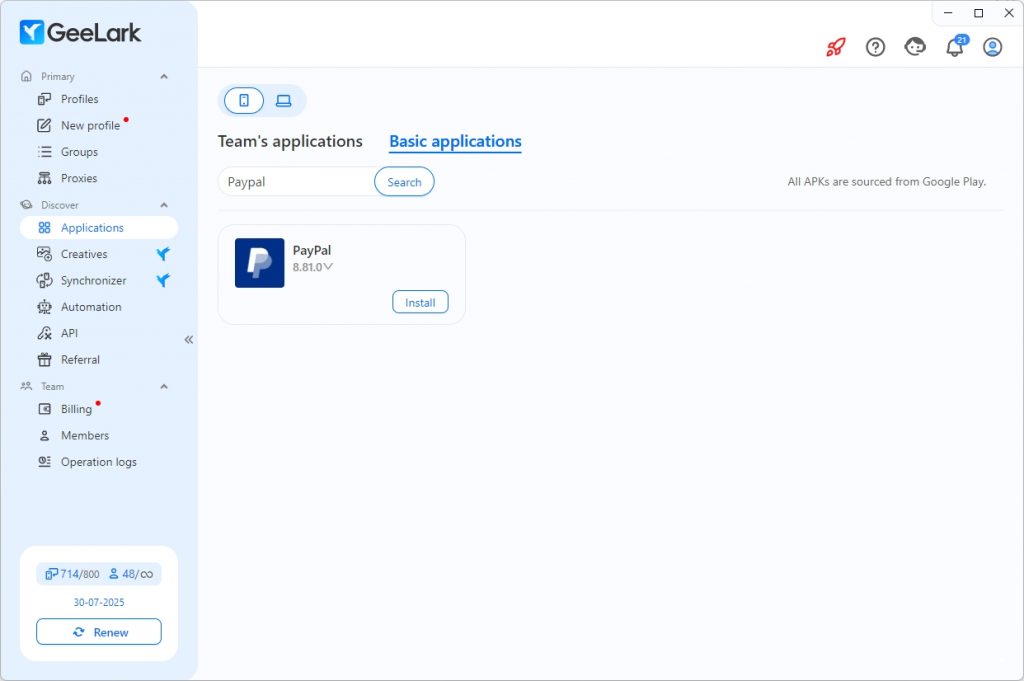

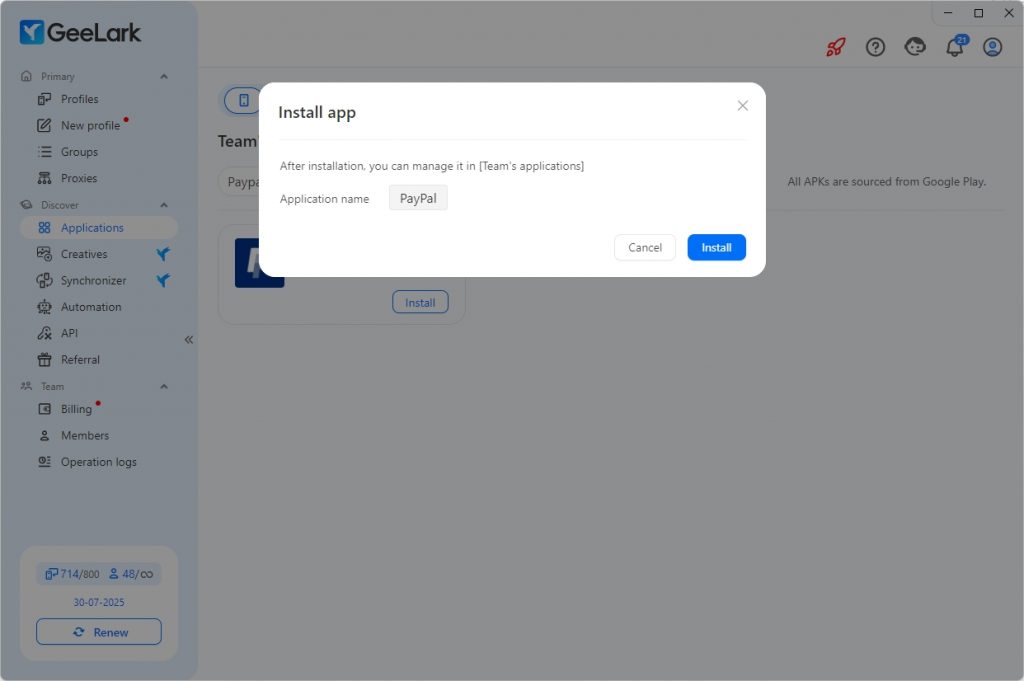

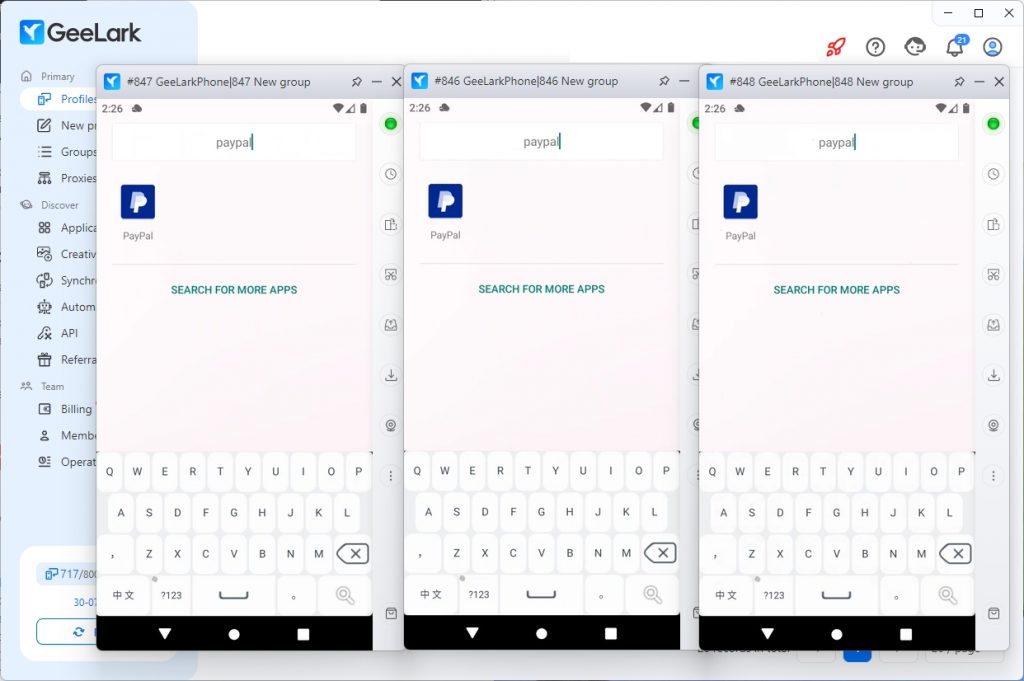

Install PayPal: Find and download the PayPal app in the Basic applications section under Applications.

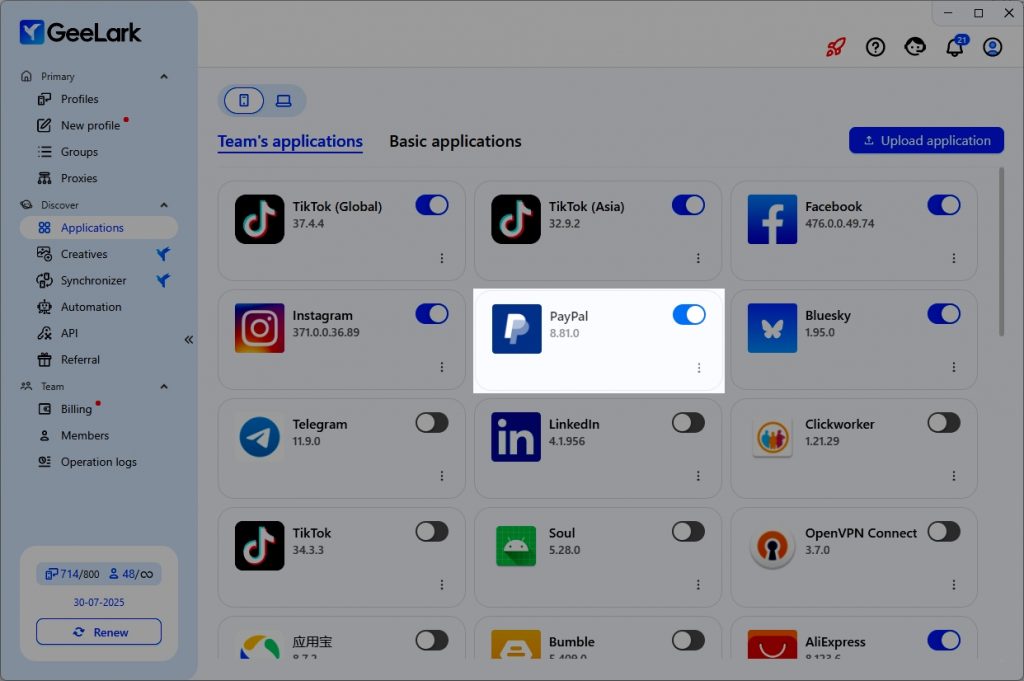

Enable Installation: Look for the PayPal icon in Team’s applications. Click it to install PayPal on all your cloud phones automatically.

Account Setup: Open PayPal on each cloud phone and create your accounts. Just remember to use different email addresses and phone numbers for each one to stay within PayPal’s rules.

You can keep an eye on everything from the GeeLark dashboard, where it’s easy to manage your profiles and add new ones when needed.